money transfer personal finance stablecoins

Stablecoins vs. Traditional FX: Which One Actually Saves You More on Transfers?

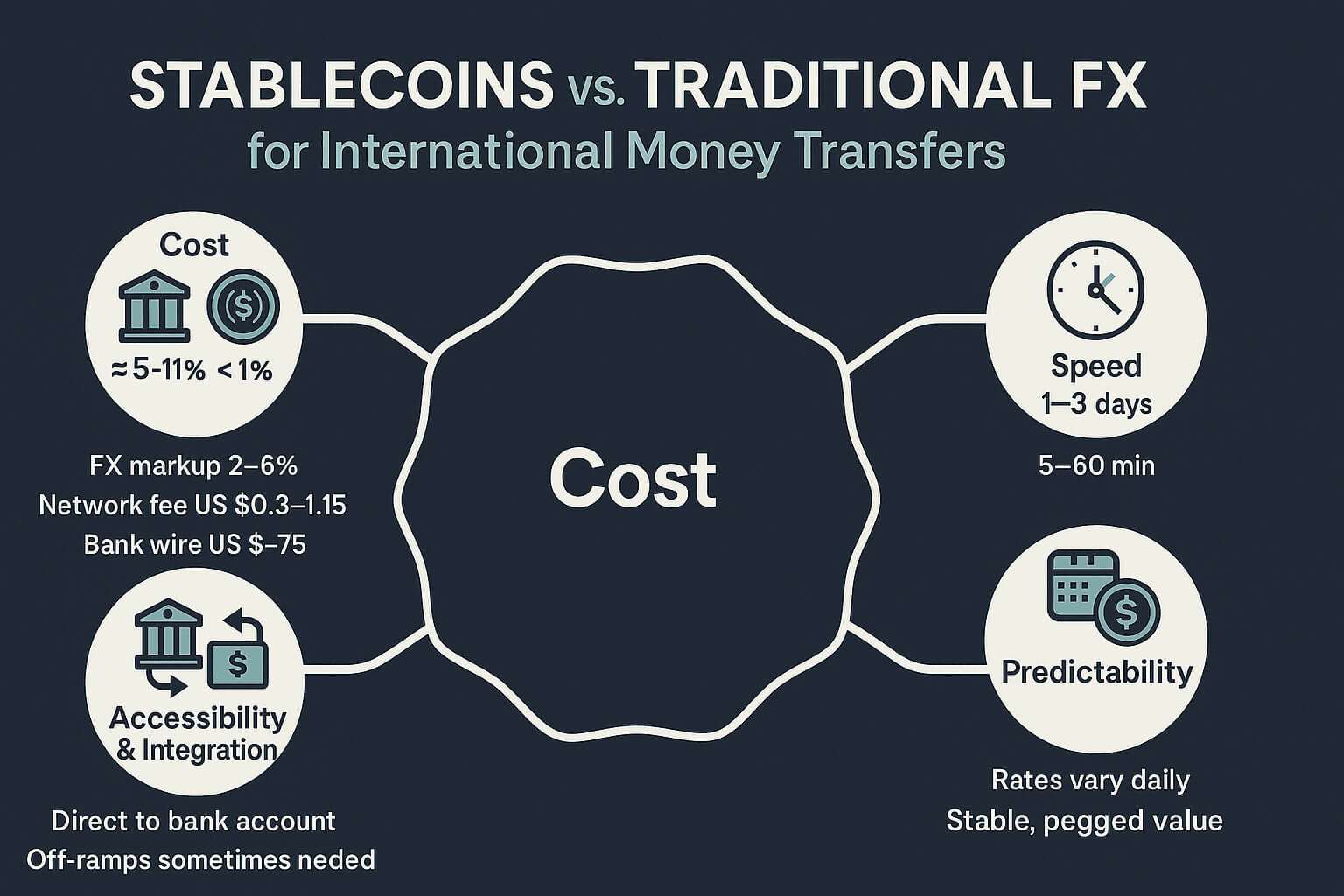

Stablecoins tend to outperform traditional foreign-exchange (FX) rails on both cost and settlement speed—even after accounting for on- and off-ramp fees. Traditional methods still hold a slight advantage when it comes to seamless bank-to-bank integration and established consumer protections. Below are the numbers to help you decide which option makes sense for your use case.

What we mean by the two contenders

Traditional FX transfer

A payment executed through SWIFT or card networks, converted at retail FX rates and delivered to the recipient’s bank account or payment wallet.

Stablecoin transfer

The movement of a blockchain-based token (e.g., USDC or USDT) pegged 1:1 to fiat currency, with value transferred across public ledgers such as TRON or Ethereum before cash-out.

Why traditional FX still feels expensive

World Bank data show that the global average cost of sending a US $200 remittance was 6.62 % in Q1 2025—well above the G20 target of ≤3 % (remittanceprices.worldbank.org). Banks introduce two main sources of friction:

Hard fees.

An outgoing international wire can cost anywhere from US $5 to US $75 depending on the institution; Wells Fargo, for example, charges US $45 for USD-denominated wires.

FX mark-ups.

The Financial Stability Board’s 2024 progress report estimates average retail FX margins at around 2 %, with base fees ranging from 2.3 % to 6 % (fsb.org).

Combined, even a “low” 3 % headline quote can easily climb past 5 % once all charges are applied.

Where stablecoins reduce costs

On-chain transfers eliminate correspondent banks and opaque FX spreads. Network fees for USDT on TRON average around US $0.315 per transaction (cryptomus.com), while ERC-20 (Ethereum) transfers typically cost about US $1.15 when the network is uncongested (cryptomus.com). Even during peak periods, TRC-20 fees usually remain below US $2 (prestmit.io).

Sending US $500: typical total cost (May 2025)

| Route | Up-front fee | FX or spread | Network fee | % of amount | Speed* |

|---|---|---|---|---|---|

| Bank wire (US → EU) | US $45 | 2 % mark-up | n/a | ≈ 11 % | 1–3 d |

| Money-transfer app (Wise mid-market) | 0.4–1.5 % | none | n/a | 0.4–1.5 % | ≤24 h |

| Stablecoin TRC-20 (USDT) | Exchange on-ramp 0.5 % | none | US $0.32 | ≈ 0.6 % | 5–60 min |

| Stablecoin ERC-20 (USDC) | Exchange on-ramp 0.5 % | none | US $1.15 | ≈ 0.73 % | 5–15 min |

*Settlement speed excludes bank cash-out times for stablecoins.

What about spreads when you cash out?

A common criticism is that converting USDC or USDT back into euros simply reintroduces FX costs. In practice, two factors often keep stablecoins competitive:

- Multi-currency wallets.

Platforms such as Quppy allow EU residents to hold both fiat and digital dollars, delaying conversion until euros are actually needed. - Peer-to-peer off-ramps.

In high-remittance corridors, recipients may spend or exchange stablecoins locally, avoiding FX conversion altogether.

Hidden savings: volatility and predictability

Traditional FX quotes fluctuate constantly, and weekend markups are common. Stablecoin transfers, by contrast, move a pegged asset, meaning the USD value is known both before and after settlement. For payroll runs or supplier invoices, that predictability can make a meaningful difference.

Compliance, security and trust

Regulation is catching up. From July 2025, MiCA will classify stablecoin issuers as e-money institutions in the EU, requiring daily reserve reporting and capital buffers. This improves transparency for risk-conscious users, while favoring wallets that already operate under EU regulatory frameworks.

What makes up your cost? (indicative share)

| Component | Traditional FX | Stablecoin |

|---|---|---|

| Provider base fee | 25 % | 10 % |

| FX mark-up / spread | 50 % | 0 % |

| Correspondent fees | 15 % | 0 % |

| Network or gas | 0 % | 80 % |

| Regulatory / compliance | 10 % | 10 % |

In traditional payment rails, most costs stem from FX spreads. With stablecoins, the main expense is network gas—typically minimal unless congestion spikes.

Key take-aways for different senders

| Sender profile | Why stablecoins shine | Why FX may still win |

|---|---|---|

| Freelancers paid in USD | Near-instant settlement, no SWIFT delays | Requires wallet familiarity |

| SMEs with recurring payroll abroad | Predictable rates; bulk USDC payouts | Some staff prefer bank deposits |

| Family remittances | Sub-1 % fees even on US $50 | Off-ramps can be limited in rural areas |

| Corporate treasury | 24/7 liquidity windows | Accounting and audit complexity |

Using Quppy as a bridge

With a multi-currency IBAN, USDC rails via Circle, and SEPA cash-out, Quppy enables hybrid flows: wire in EUR, convert to USDC, pay contractors on TRON, or move funds back to fiat the same day. Users can choose the cheapest leg at each step and retain the savings.

If you searched for “cheapest international money transfer” and landed here, the answer in many cases is an on-chain stablecoin paired with a reliable off-ramp—provided you use a regulated wallet and a low-fee network.

Bottom line

For everyday cross-border payments, stablecoins have reshaped expectations around cost and speed. By removing FX markups, reducing fees to cents, and settling transactions in minutes rather than days, they often deliver clear savings outside of niche edge cases.

In a world focused on faster and cheaper money movement, blockchain-based rails have already set a new benchmark—while traditional banking continues to adapt.

FAQ

Yes. In most corridors, the all-in cost is under 1 %, compared with roughly 5–11 % for traditional wires, due to minimal network fees.

On networks such as TRON or Solana, confirmation typically occurs within a minute. Funds are usable once finality is reached—far faster than the 1–3 days common for bank settlements.

A hybrid route works well: send USDC to a regulated wallet like Quppy, then convert it to fiat via SEPA rails or a local OTC partner, combining speed with bank familiarity.

Key risks include issuer insolvency and private-key loss. These can be mitigated by using regulated custodial wallets, diversifying across issuers (e.g., USDC and EURC), and enabling hardware or multi-signature protection.

Yes. From 2025, MiCA introduces enhanced disclosure and passporting requirements, classifying fiat-pegged tokens as e-money. Wallet providers must comply with AML and KYC standards similar to those for conventional cross-border payments.

Try the free app

Bring digital & fiat together, with no compromise!